what is hospital indemnity cigna

However your provider will often take care of filing a claim with Cigna so that you will be reimbursed. What this means to you is that Medicare pays first and the IRMP Cigna Indemnity plans will pay secondary.

Hospital Indemnity Insurance The Hartford

The Hospital Indemnity Insurance policy pays the specific fixed benefit dollar amount you selected when applying regardless of the amount charged by providers.

. Supplemental health benefits such as Cigna Hospital Care can offer a cost. Hospital indemnity insurance also known as hospital confinement insurance or simply hospital insurance is supplemental medical insurance coverage that pays benefits if you are hospitalized. Hospital Indemnity Insurance is a policy that pays you a fixed cash benefit for hospital admittance and in-patient services.

The base Hospital Indemnity benefit provides a certain dollar amount per day you are in the hospital that is picked by you the policyholder. One will pay you a lump sum if youre confined in a hospital. A hospital stay can be expensive and it can happen at any time.

The plan pays individuals a lump sum to use as they see fit. Even with medical coverage out-of-pocket expenses such as rehabilitation transportation and childcare can quickly add up. Individuals who file a claim can receive a certain amount each day to spend however they choose for up to one or two years.

It can provide you and your family with the coverage and additional financial protection you may need for expense associated with an. The other choice will pay you a set amount for each day that youre confined in the hospital. How the CIGNA Indemnity Plans work.

The plan pays individuals a lump sum to use as they see fit for a covered. Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental health insurance. In addition any charges for services treatment or supplies furnished by a Provider who has.

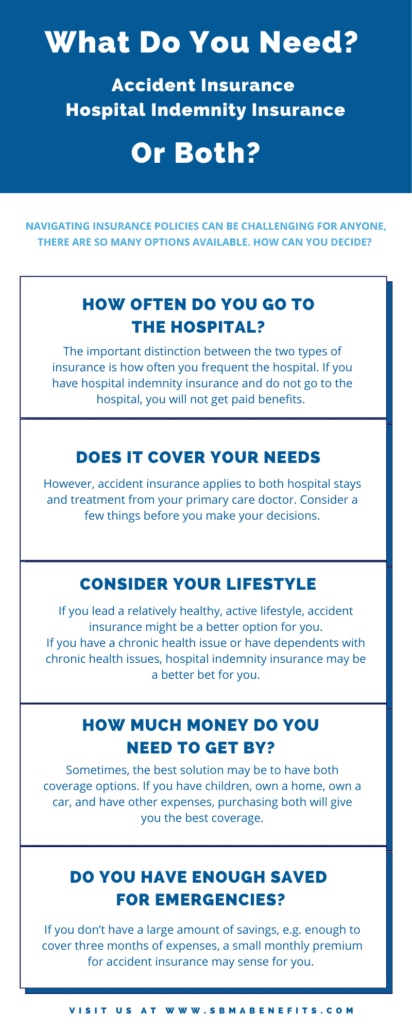

The number of days youre in the hospital doesnt change the total amount youll be paid. A Hospital Indemnity Plan Gives You Protection. Hospital Indemnity is an option that you can add to your overall health insurance portfolio.

It is rare that any plan covers all of the expenses of an accident or. Group hospital indemnity insurance Cignas new group hospital indemnity insurance policy Cigna Hospital Care helps customers pay for costs associated with unexpected medical bills when they are admitted to a hospital for a covered injury or illness. Hospital Indemnity from Cigna.

Get a lump-sum payment on top of your normal health plan coverage in case youre hospitalized due to an accident or illness. It pays you a specified amount for each day of covered service you receive no matter what the final billed charges are. The IRMP CIGNA Indemnity plans assume you are enrolled in Medicare Part A and B and will not pay benefits that are normally paid by Medicare.

Hospital stay resulting from a Covered Injury or Covered Illness. You have two coverage optionshigh and low. Intensive Care Unit Admission.

Life other than GUL accident critical illness hospital indemnity and disability plans are insured or administered by Life Insurance Company of North America except in NY where insured plans are offered by Cigna Life Insurance Company of New York New York NY. Hospital Care Indemnity Insurance. April 07 2022 Hospital indemnity insurance covers hospital stays.

Medical Indemnity plans also known as an Indemnity Health Plan are health plans designed to give you choices when choosing health care providers and facilities. In other words you are admitted to the hospital for an overnight stay. Help your employees focus on getting better and worry less about hospital bills.

What does Cigna indemnity mean. Accidental Injury Critical Illness and Hospital Care plans or insurance policies are distributed exclusively by or through operating subsidiaries of Cigna Corporation are administered by Cigna Health and Life Insurance Company and are insured by either i Cigna Health and Life Insurance Company Bloomfield CT. Your patients with this Cigna coverage pay the cost of the visit and typically are responsible for.

Who Can Elect Coverage. Hospital indemnity insurance is a type of health coverage plan designed to cover hospital stays. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

You have two main choices for a Hospital Indemnity plan. A Hospital Stay Can Happen At Any Time And It Can Be Costly. Group Universal Life GUL insurance plans are insured by CGLIC.

Hospital indemnity insurance helps by putting recovery first over hospital bills. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. The Cigna HealthCare indemnity plan allows plan participants to visit any medical care practitioner.

When it comes to the health of you and your family unexpected or long-term hospitalizations should not be a time to worry about medical costs. Ii Life Insurance Company of North America LINA Philadelphia. Cignas new group hospital indemnity insurance policy cigna hospital Care helps customers pay for costs associated with unexpected medical bills when they are admitted to a hospital for a covered injury or illness.

Again these situations are for in-patient situations. By signing up for Cignas Hospital Care Plan you can supplement your health plan. They also dont need a referral to see a specialist.

Hospital Indemnity Insurance for Individuals Cigna. A regular full-time Employee of a participating Cigna company regular part-time Employee of a participating Cigna company regularly scheduled to work at least 28 hours each week who is working in the United States the District of. The hospital indemnity plan supplements other medical care insurance you may carry.

Indemnity plan participants dont choose a primary care physician PCP to coordinate their care and treatment. 4 While health insurance pays for medical services after copays co-insurance and deductibles are met hospital indemnity insurance pays you if you are hospitalized. Depending on the plan.

Hospital indemnity insurance is another supplemental insurance used to prepare for the cost of labor and delivery. If you choose a Medical Indemnity health plan through Cigna its important to know the key features. Accident or Sickness Benefit.

This generally ranges from 100 to. Hospital Indemnity Insurance All insurance policies and group benefit plans contain exclusions and limitations. Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer.

Life doesnt announce surprises.

4 Facts You Need To Know About Hospital Indemnity Insurance

File A Hospital Indemnity Insurance Claim American Fidelity

Hospital Indemnity Vs Accident Insurance Sbma Benefits

Sidecar Health Access Plan Review Who Is It Good For Valuepenguin

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Benefits Accident Critical Illness And Hospital Indemnity

Cigna Indemnity Hmo Benefit Summary

Employers Help Shape Financial Safety Net Critical Illness Indemnity Insurance Financial

4 Facts You Need To Know About Hospital Indemnity Insurance

Hospital Indemnity Insurance What You Need To Know

How Hospital Indemnity Insurance Works Guardian

![]()

Group Hospital Indemnity Insurance

What Is The Difference Between A Ppo Plan Vs An Indemnity Plan Youtube